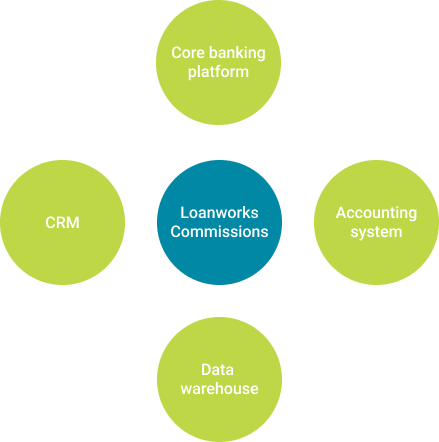

Process commissions seamlessly, using a solution that imports, validates, processes and distributes payments.

With the Loanworks commissions solution, managing your brokers and their commissions is easy. It will dramatically reduce your error margin and troubleshooting time, leaving you far more time for improving your relationships with aggregators and brokers, and writing more loans. It’s an end-to-end solution that’s specifically designed for lenders, aggregators and broker groups, and covers the entire process…

- Onboard introducers

- Manage relationships & commission plans

- Automate calculations & payments

- Access real-time reports

Manage your introducer relationships

Managing your introducers is simple with the Loanworks commissions solution. Using our simple user interface, you can quickly and easily:

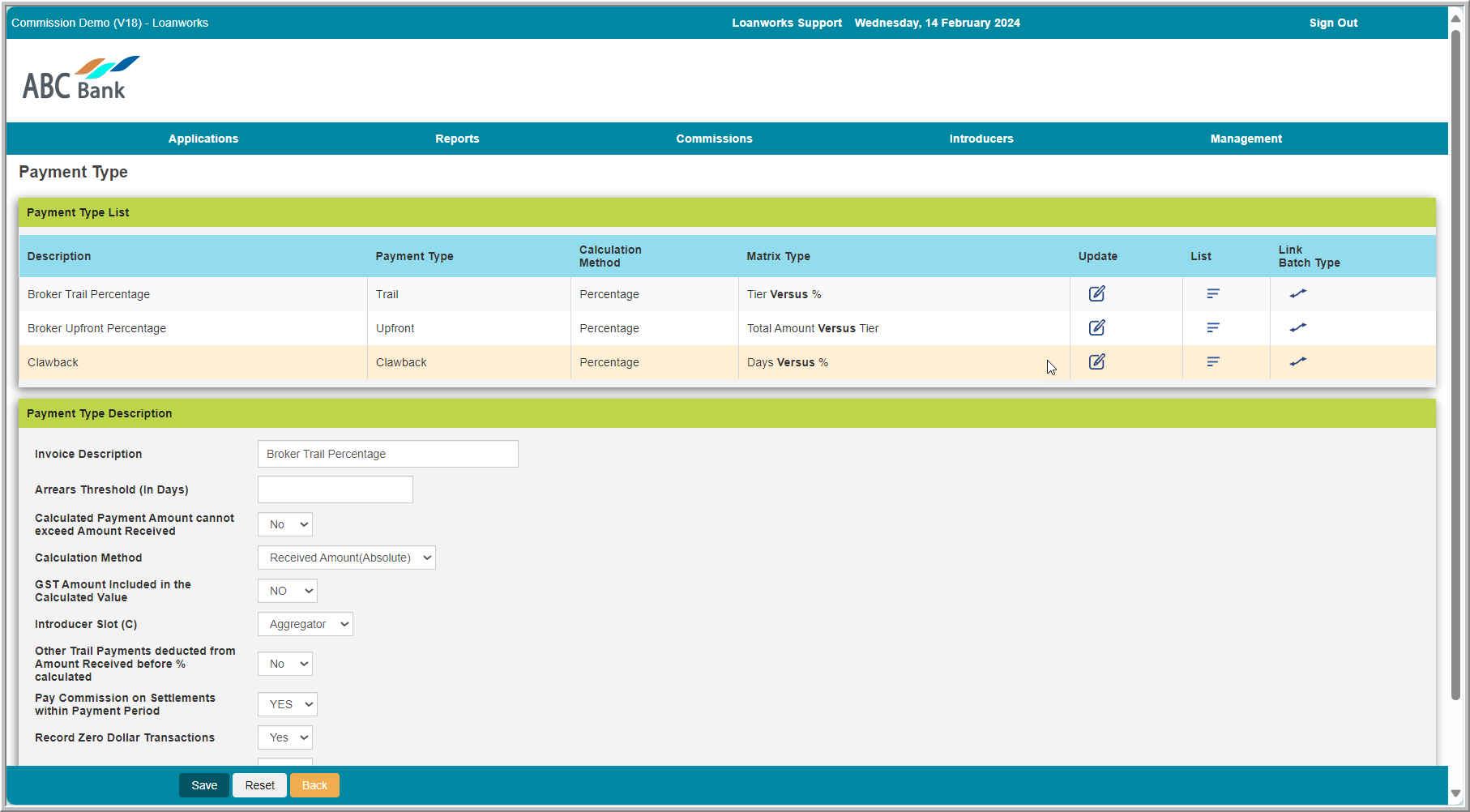

- Configure and maintain your standard commission models

- Add new introducers

- Maintain their details

- Put them on hold if necessary

- Configure and maintain their individual commission plans

- Remove them from your database when you stop working with them